|

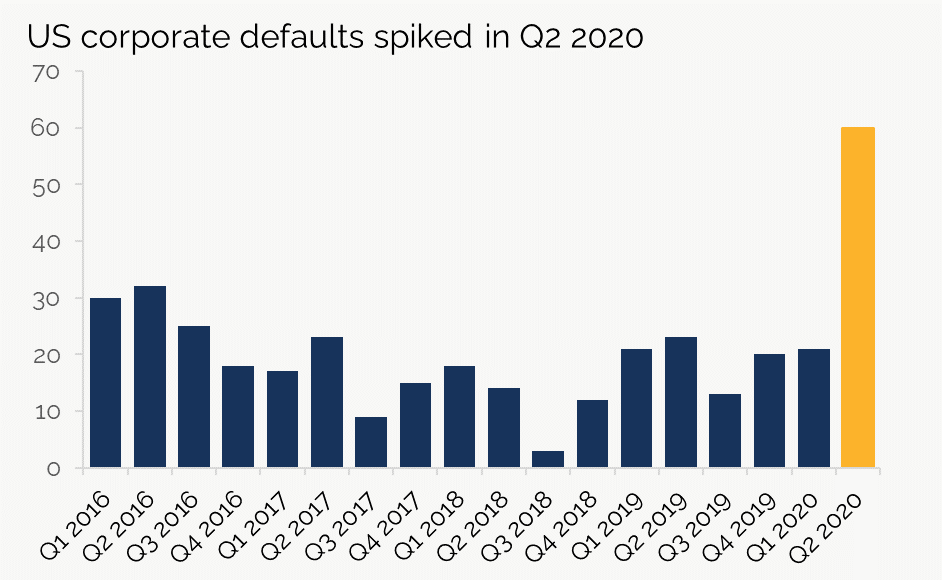

US corporate downgrades hit new high in Q2 2020

Our latest ETF, the Tabula North American CDS High Yield Short ETF (TABS) allows investors to take short exposure to North American high yield credit, providing an effective hedge without the need to become a forced seller.

S&P report that US corporate downgrades reached a record high of 414 in Q2 2020, as the sudden stop US recession deepened.

Meanwhile, the ratings agency recorded a near tripling in the number of US corporate defaults, rising to 60 from 21 in the first quarter. The 81 defaults in the first half of 2020 outnumber 2019’s full-year total of 77.

With a growing number of downgrades and a rising proportion of issuers with a negative credit bias,* S&P forecast that the US trailing 12-month speculative-grade corporate default rate will continue to climb, reaching 12.5% in March 2021 (compared to just 3.5% in March 2020).

Data: S&P Credit Research, as at 30 June 2020. * The percentage of issuer credit ratings with negative outlooks or on CreditWatch with negative implications. Data: S&P Credit Research, as at 30 June 2020. * The percentage of issuer credit ratings with negative outlooks or on CreditWatch with negative implications.

Tabula insights: What investors really want from ESG

We asked 120 European professional investors* for their views on fixed income ESG ETFs. We found that, overwhelmingly, they want more innovation. Our survey also revealed an interesting preference for outperformance potential over benchmark tracking.

* Based on 120 professional investors surveyed in May/June 2020 by Tabula Investment management (“Tabula”) or independent research company Pureprofile. Tabula commissioned Pureprofile to interview professional investors across seven European countries.

|