|

Hotel group Accor and French car component manufacturer Valeo downgraded to high yield

The on-the-run iTraxx Europe index saw two downgrades last month, as hotel group Accor and car component manufacturer Valeo shifted to high yield. Accor posted a first half loss of €227m while plunging demand for cars drove Valeo's downgrade. These names remain in the CDS index until the semi-annual roll on 21 September. However, the monthly rebalance of the investment-grade only reference index for the Tabula IG Bond UCITS ETF saw both names become ineligible for inclusion.

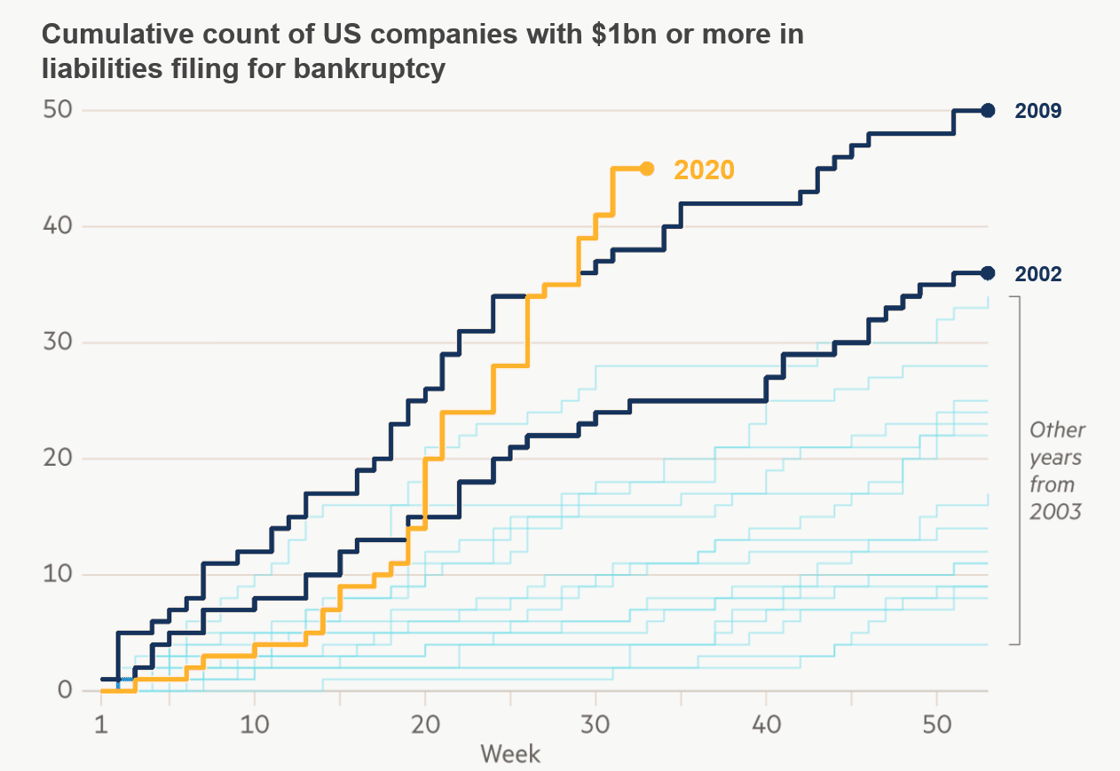

Pandemic triggers wave of US bankruptcies

The FT reports that a record number of large companies in the US have filed for Chapter 11, despite trillions in government aid. Large US corporate bankruptcy filings are set to surpass levels reached during the 2009 global financial crisis.

Data: FT and BankruptcyData.com as at 17 August 2020. Data: FT and BankruptcyData.com as at 17 August 2020.

The Tabula North American CDX High Yield Short ETF ("TABS") allows investors to take short exposure to North American high yield credit, providing an effective hedge without the need to become a forced seller.

|